Report 12-Consuming and purchasing trend: Women in their 20s in Ho Chi Minh City

Analyst: Bui ThiThanh, INTAGE VIETNAM LLC.

Overview

- Women in their 20s in Ho Chi Minh City value ’good quality’ when shopping.

- They value ’hopes and dreams’ the most, also rapidly increasing numbers of them respect their own standards.

- Products or service fitting their own needs perfectly are popular.

- Younger generations use ’internet’ and ’smartphones’ significantly more than before.

- Japanese culture has significant influence on women in their 20s.

Analysis

Purchase behavior: Women in their 20s in Ho Chi Minh City

Vietnam has a higher percentage female labor force, compared to that of other countries in Asia. Double-income couples/families are very common in Vietnam. Young women (especially in their 20s) have strong influence on purchasing products and services for a whole family. Accordingly, young female consumers can be described as essential targets in Vietnamese markets.

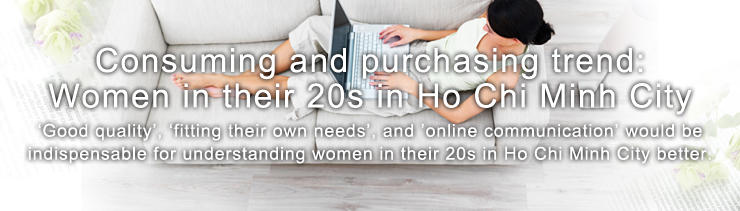

[Figure 1] Purchase behavior: Women in their 20s in Ho Chi Minh City

The first upper section shows the highest-rated choice for each question.

The lower section shows the choice(s) with the biggest increase compared to the previous survey conducted in 2012. The number in brackets shows the increase in points from 2012 to 2014.

High quality and fitting one’s need perfectly

Survey results clarifies that women in their 20s in Ho Chi Minh City put the most importance on ’high quality’ when shopping. Also, the choice ’production country’ has the biggest increase, compared to the results of the previous survey in 2012. This could be interpreted as their necessity for safety of products, for Vietnamese markets often suffer from counterfeit products.

Women in their 20s in Ho Chi Minh City put the largest importance on ’hopes and dream’ when it comes to ’attitude’. Also the choice ’my own standards’ has the biggest increase, compared to the results in 2012. Vietnamese consumers used to have very limited range of products and services. Generally speaking, Vietnamese women had tendency to choose products and services with much stress on family. Today, younger women have tendency to choose products and services suitable rather for their own lifestyle and individual needs, mainly due to higher life standard and increased numbers of independent women.

For example, the results in 2014 shows that products and services meeting individual needs such as ’spa at home’ and ’nail salon (unique design for nails)’ has become more popular.

Online communication

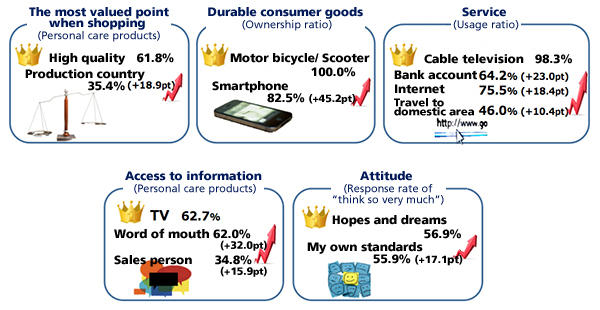

The survey results in 2014 clarifies that the number of internet and smartphone users has significantly increased among young generation, compared to those in 2012. The ownership ratio of smartphones has almost doubled to 80 percent of all respondents.

[Figure 2] Ownership ratio of smartphones (women in their 20s in Ho Chi Minh City)

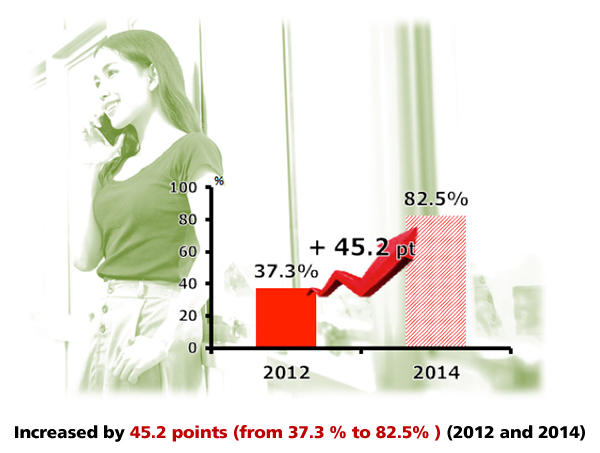

The usage ratio of internet at home increased 57.1 to 75.5%

[Figure 3] Usage ratio of internet at home (women in their 20s in Ho Chi Minh City)

Vietnamese customers used to go to shops immediately in order to purchase products and services. Today, it is not until they acquire enough information via online that they go to shops for purchasing. Such a transition in purchasing behavior requires a new marketing strategy such as providing information via online interactive survey with customers.

For example, many restaurants popular among young generation offer coupons or discount tickets on information websites (e.g. Facebook, Zalo, Foodie, Tripadviser, and Hotdeal). Actually, such websites function as a communication tool between guests and restaurants.

Japan-boom generation and future strategies

Generally speaking, women in their 20s are greatly influenced by Japanese culture. A decade ago, Japan used to be recognized with a limited number of high-quality durables. Recent expansions of Japanese companies in Vietnamese market caused more Vietnamese to try Japanese products and services other than high-quality durables.

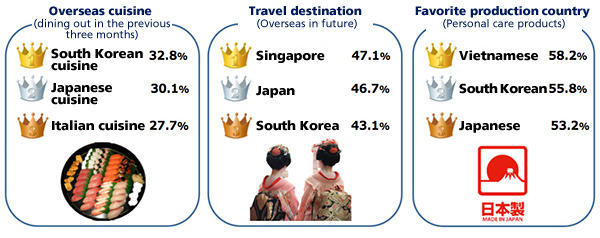

For example, the survey results clarifies that many Vietnamese are interested in Japanese dishes when dining out. Not only Korean or Italian, but also Japanese dishes are very popular among them.

The results also show that the percentage of Vietnamese who tried Japanese dishes within the previous three months increased drastically and reached 30 percentage, an almost doubled value.

In addition, Japan won the second prize as a travel destination abroad in the future (Singapore won the first prize). Also, Japanese personal care products won the third prize as for future use (Vietnamese and South Korean products won the first and second prizes each).

[Figure 4] Japan boom: Women in their 20s in Ho Chi Minh City

Increasing strong support for Japanese products and services among women in their 20s would be derived from high-quality products mentioned above. The very positive image toward Japanese products and services among women in their 20s (e.g. Japanese products equal high-quality.) would certainly accelerate Japanese enterprises when they launch new products and services in Vietnamese market.

However, it should not be overlooked that ’high quality’ is not enough in Vietnamese market. What could make Japanese products even more attractive from Vietnamese women’s point of view? It would be ’fitting their needs (personality)’ that young female consumers value, and clear message that Japanese products could help them to express their originality. Communication would be also a key here. ’How to communicate’ and ’What to communicate’ could be flexibly adjusted to Vietnamese market, and ’communication story’ should express originality of each manufacturing company.

Survey Overview

| Survey Method | Visit-and-Interview survey via quota samplings at random locations |

|---|---|

| Survey Period | July 2014 (The previous survey conducted in July 2012) |

| Survey Samples | 1,500 female individuals aged 20 to 59 and classified as A to D of SEC*1 who have lived in Bangkok (Thailand), Delhi (India), Jakarta (Indonesia), Shanghai (China), or Ho Chi Minh City (Vietnam) for three years or more (300 persons per city). |

| Organization Conducting the Survey | INTAGE Group |

ASIA INSIGHT REPORT

INTAGE Inc. publishes the "Asia Insight Report" based on independent surveys conducted in Asian regions in collaboration with overseas INTAGE group companies to identify trends in attitudes and behavior on a variety of themes.

Part 12 of the Report features the consuming and purchasing trend: Women in their 20s in Ho Chi Minh City.

This Report draws upon the results of the "Third Asia Insight Research,*2" which was conducted jointly by INTAGE Inc. and other overseas Group companies in July 2014.

- *1SEC : Social Economic Class

- *2Asia Insight Research : A series of independent joint surveys are conducted every year by INTAGE Inc. and overseas INTAGE Group companies in Asia. The research collects data such as consumer opinions, evaluations and perceptions in several Asian cities by studying their lifestyle and consumption habits.