Report 17-Online Shopping Trends in 4 Asian Cities

Overview

- Ho Chi Minh City had the most online shoppers out of the four cities.

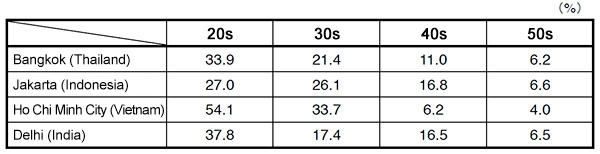

- The majority of online shoppers in all four cities are in their 20s and 30s.

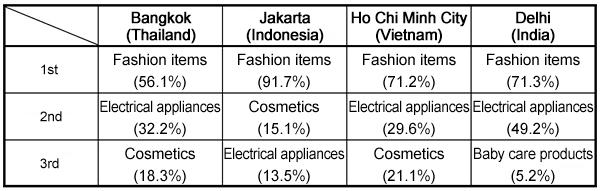

- The top product category for online purchases in all four cities was fashion items.

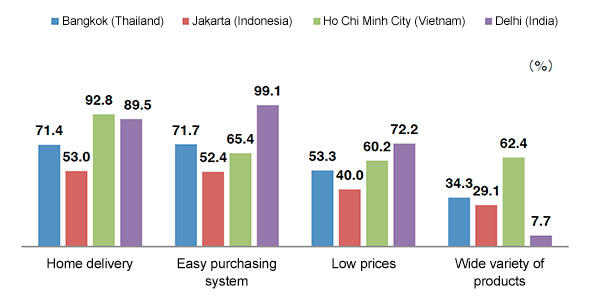

- Many people shop online for reasons of convenience such as having the products delivered to their homes and the easy purchasing system.

Conclusions

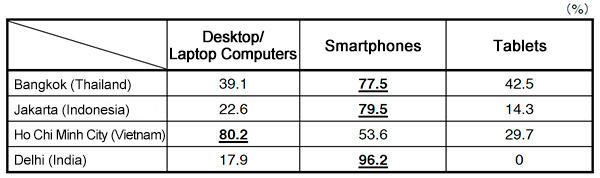

The results showed that 20 to 30% of people in the 4 Asian cities do their shopping online. Looking at the results according to age group, the majority of online shoppers in all 4 cities are in their 20s and 30s, and many of them use their smartphones.

In the 4 Asian cities, where public transportation is not available to the extent that it is in Japan, traffic congestion is still a major problem. As a result, it takes a long time to get anywhere, and getting around on a motorcycle is difficult beyond a certain distance. This type of inconvenience has led to a demand for online shopping. Consumers shop online not only for purchasing products but for a wide range of purposes, such as services.

Currently, most online shoppers are purchasing fashion items, electrical appliances, and cosmetics. Online shoppers tend to value convenience and price. Therefore, the consumption of other product categories is expected to grow if these factors are met.

Analysis

1. Prevalence of online shopping

Out of the 4 cities, Ho Chi Minh City had the most online shoppers (31.7%) over the last 6 months. Delhi, Jakarta, and Bangkok followed at 23.6%, 22.0%, and 16.5%, respectively.

[Figure 1] Online shopping trends

[Base: Overall]

2. Users of online shopping

The majority of online shoppers in all four cities are in their 20s and 30s, and a large number of them use their smartphones for their shopping. In Ho Chi Minh City, a large percentage of people do their online shopping on a desktop or laptop computer (80.2%). This is a reflection of the large number of people in Ho Chi Minh City who make their purchases on their computers at work.

[Figure 2] Online shopping prevalence according to age group

[Base: Overall]

[Figure 3] Online shopping prevalence according to type of device (Multiple answers)

[Base: Number of online shoppers in last 6 months]

3. Categories purchased online

The top product category for online purchases in all four cities was fashion items. This was followed by electrical appliances and cosmetics. Categories found at the top of the rankings were pretty much the same in each country, although there were some differences in the order.

[Figure 4] Top 3 product categories for online purchases (Multiple answers)

[Base: Number of online shoppers in last 6 months]

4. Reasons for online shopping

Many people shop online for reasons of convenience such as having the products delivered to their homes and the easy purchasing system.

[Figure 5] Reasons for shopping online (Multiple answers)

[Base: Number of online shoppers in last 6 months]

Survey Overview

| Survey Method | Visit-and-interview survey via quota samplings at random locations |

|---|---|

| Survey Period | April 2016 (The previous survey conducted in June 2015 and the survey before last conducted in July 2014) |

| Respondents | 1,200 individuals aged 20 to 59 and classified as A to D of SEC*1 who have lived either in Bangkok (Thailand), Jakarta (Indonesia), Delhi (India), Ho Chi Minh City (Vietnam), or Delhi (India) for three years or more (300 persons per city). |

| Organizations Conducting the Survey | INTAGE Inc. and INTAGE Group companies overseas |

ASIA INSIGHT REPORT

INTAGE Inc. (Headquarters: Chiyoda-ku, Tokyo, President and Representative Director: Noriaki Ishizuka) published the "Asia Insight Report" based on independent surveys conducted in Asian regions in collaboration with INTAGE Group companies to identify trends in attitudes and behavior on a variety of themes. Part 17 of the Report features "Online Shopping Trends in 4 Asian Cities." This Report focuses on online shopping trends, and draws upon analysis of the differences between each city as clarified by "Asia Insight Research,*2" which was conducted jointly by INTAGE Inc. and other Group companies.

- *1SEC : Social Economic Class

- *2Asia Insight Research : A series of independent joint surveys are conducted every year by INTAGE Inc. and overseas INTAGE Group companies in Asia. The research collects data such as consumer opinions, evaluations, and perceptions in several Asian cities by studying their lifestyle and consumption habits.