Health Care

Health Care

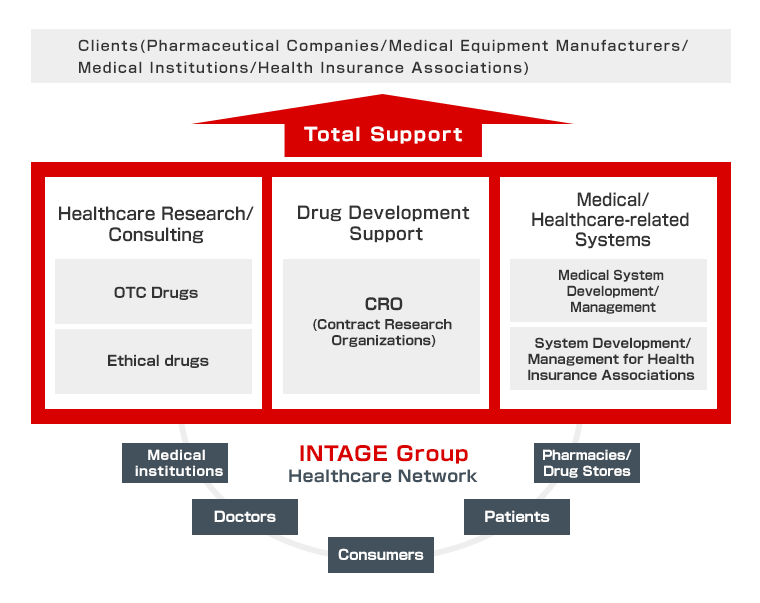

The INTAGE Group serves the Health Care industry by providing marketing research, business solutions and solutions-style clinical trial services as part of our pharmaceutical development support business. We provide various solutions as an outsourcing partner for pharmaceutical companies in the pharmaceutical development process.

Health Care Consulting

INTAGE supports decision-making and business execution through all phases, from business strategy to post-product launches, both in Japan and overseas.

Health Care Research (OTC Drugs)

We provide continuous research on such themes as sales trends for over-the-counter (OTC) drugs, consumers’ health conditions, and their levels of consciousness.

Surveys to understand the actual conditions in the health foods/supplements market

INTAGE conducts surveys on the actual usage of health foods/supplements in order to categorize health foods depending on the consumers’ purpose of use, to understand user groups and their purchase/usage behavior and attitudes for each category, to understand the size of the actual/potential market, and for other purposes.

SRI+® (Nationwide Retail Store Panel Survey)

INTAGE provides sales trend data that we have collected and analyzed, covering approximately 6,000 stores nationwide including supermarkets, convenience stores, home centers/discount stores, drug stores, and specialty stores in Japan.

Health and Lifestyle Survey

INTAGE conducts continuous surveys on people’s lives and their health.

Health Care Trend Panel Survey

INTAGE conducts surveys on consumers’ physical symptoms and methods of treatment.

Health Care Research (Prescription Drugs)

INTAGE conducts research on a broad range of themes centered on prescription drugs. We can meet the various research needs of product development.

CRO (Contract Research Organizations)

We provide higher quality CRO services to pharmaceutical clients mainly, a Group company specializing in the CRO field.

IT Solutions

We offer an extensive range of IT-based solutions for pharmaceutical companies, medical equipment manufacturers and health insurance associations.

For the pharmaceutical industry

Drawing on our experience in the pharmaceutical industry, we provide solutions to quickly discover the business challenges of our clients and resolve those challenges.

For health insurance and health management

We provide business support solutions, including systems for corporate health management and for the core operations and insurance business of health insurance associations, in a high-security environment.

We propose the sort of marketing research that can deal with your company's challenges.

Please feel free to contact us. The relevant team member will get in touch with you.