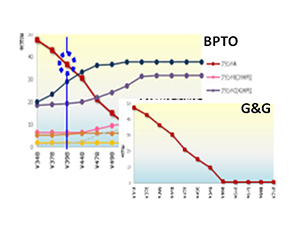

BPTO / Gabor&Granger

Optimal price simulation using INTAGE’s proprietary theory and technology

*BPTO: Brand Price Trade Off

For Addressing the Following Issues

Optimal price

What is the optimal price given your brand’s current health status and changes in the external environment?

Understanding price elasticity

Calculate brand-specific price elasticity using INTAGE’s original BPTO analysis logic

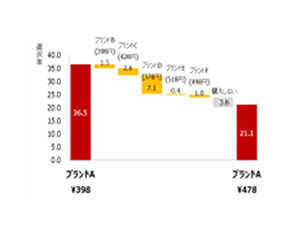

Inflow and outflow caused by price changes

How will the pricing points affect the flow of users to and from competing brands?

Simulation of inflow and outflow at different prices

Learn the price elasticity of your brand and your competitors’ brands, and ascertain the inflow and outflow of users at different price settings

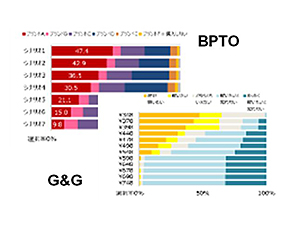

Share simulation

What will happen if previously-unimplemented pricing points are used?

Simulation of previously-untested prices

Identify the pricing points for gaining share by running share simulations for different price combinations

What the Output Looks Like

Price elasticity

Inflow and outflow caused by price fluctuations

Share simulation

FAQ

As an optional service, we can correct the price elasticity of the price increase intervals obtained via BPTO by taking into account the price elasticity of (real-life) retailer panel data.

We propose the sort of marketing research that can deal with your company's challenges.

Please feel free to contact us. The relevant team member will get in touch with you.